23 Jun Green Financing: Powering a Sustainable Future

In the face of intensifying climate change, depleting natural resources, and rising environmental crises, traditional growth models that are heavily reliant on fossil fuels and unchecked consumption are no longer viable. The future depends on a transition to a low-carbon, sustainable economy, for which green financing is a powerful tool that is reshaping the way we invest in our planet’s future.

What Is Green Financing?

Green financing refers to the process of raising and allocating capital for projects that deliver environmental benefits and support sustainable development. It includes initiatives like renewable energy projects, sustainable transportation, green buildings, biodiversity conservation, and climate-resilient agriculture. This form of financing is often facilitated through mechanisms like green bonds, green loans, sustainability-linked finance, and public-private partnerships. But green financing is more than a technical financial mechanism. It’s a strategic move that has the potential to safeguard the planet while creating long-term economic value.

Green financing offers several significant benefits for institutions, whether they are banks, businesses, governments, or investors. Some of the key advantages are-

- Attracts sustainable investment capital

Green financing attracts capital from environmentally and socially responsible investors.

Example Areas: Renewable energy (solar, wind), green buildings, sustainable transport. - Strengthens institutional reputation and market position

Organizations adopting green finance often gain trust and brand value in the eyes of stakeholders.

Example Areas: Corporate sustainability bonds, climate risk disclosure initiatives, net-zero transition planning. - Improves compliance and access to incentives

It helps companies meet environmental regulations and qualify for green subsidies, tax breaks, and favorable financing.

Example Areas: Energy-efficient manufacturing, low-emission fleet upgrades, green certification programs. - Reduces long-term risk exposure

By financing sustainable projects, institutions mitigate physical, regulatory, and reputational risks related to climate change.

Example Areas: Climate-resilient infrastructure, sustainable water management, and eco-insurance models. - Drives innovation and long-term profitability

Green financing fuels research, innovation, and deployment of sustainable technologies.

Example Areas: Carbon capture and storage (CCS), Sustainable agriculture and aquaculture, Biodiversity conservation technologies, New green materials (e.g., bioplastics, low-carbon cement), Waste-to-energy systems

Why Green Financing Is Strategically Vital

Despite ongoing geopolitical tensions and economic uncertainty, the tenth edition of the International Energy Agency’s (IEA) World Energy Investment report projects that global energy sector investment will increase to USD 3.3 trillion in 2025, reflecting a 2% real-term rise compared to 2024. Notably, approximately USD 2.2 trillion of this investment is expected to be directed toward low-carbon energy technologies, including renewables, nuclear energy, electricity grids, storage systems, low-emission fuels, energy efficiency, and electrification. This amount is twice the projected investment of USD 1.1 trillion in fossil fuel sectors such as oil, natural gas, and coal. This is a significant milestone, marking the first time that clean energy investment is expected to outpace fossil fuel funding at a global level.

Similarly, green bond issuance, which is often used by governments, banks, and corporations to raise funds for eco-friendly projects, has emerged as a vital instrument in advancing sustainable finance and addressing global environmental challenges. Since the World Bank began issuing green bonds in 2008, it has raised over USD 20 billion through more than 230 bonds in 28 currencies, signaling a strong institutional commitment to green development. The broader green bond market has seen substantial growth, and the market regained momentum in 2024, with annual issuance reaching USD 1.1 trillion, marking a 5% increase from the previous year.

These are not just isolated figures; they reflect a growing recognition that sustainable finance is key to economic resilience, innovation, and environmental stewardship. What drives this momentum is the understanding that the consequences of inaction, like climate disasters, food insecurity, and mass displacement, are far more costly than the investments needed to prevent them.

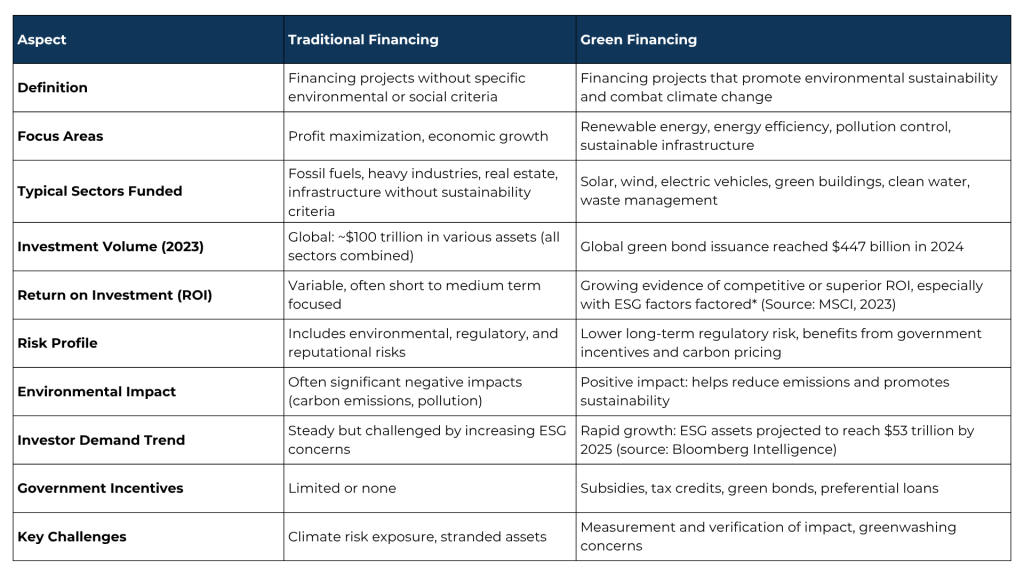

Traditional Financing vs Green Financing: A Comparative Overview

Environmental Impact: Beyond the Numbers

The environmental benefits of green financing are broad and measurable. Financing renewable energy projects directly reduces greenhouse gas emissions by replacing coal, oil, and gas with clean alternatives like solar, wind, and hydro. These investments help curb the pace of global warming, making net-zero targets more achievable.

Green finance also plays a crucial role in preserving biodiversity. By supporting sustainable land use and deforestation prevention programs, capital can flow into protecting vital ecosystems. Moreover, energy efficiency initiatives funded through green mechanisms lead to smarter infrastructure, lower consumption, and less pollution in urban and rural communities alike.

Looking Ahead: The Role of Policy and Innovation

While the growth of green finance is encouraging, its future depends on stronger policy frameworks, international cooperation, and innovation. Governments can accelerate green financing by offering incentives, implementing carbon pricing, and ensuring that financial regulations promote sustainable investment. Likewise, financial institutions must integrate environmental risk assessments into lending and investment decisions.

Innovative instruments like blended finance, sustainability-linked bonds, and green fintech are also expanding, making green financing more accessible and impactful across the globe. Green financing is no longer a niche concept; it is an essential driver of the global sustainability agenda. By redirecting capital toward projects that restore ecosystems, reduce emissions, and create resilient infrastructure, green finance unlocks the potential for a better, cleaner future.

As individuals, institutions, and governments rally around the cause of environmental stewardship, green financing stands as a practical path forward. It proves that economic growth and environmental responsibility are not opposing goals, but rather, can be powerfully aligned in shaping the world we all want to live in.

Blog by Shreya Ghimire,

Research Analyst, Frost & Sullivan Institute